Levy Fundamentals

-

A levy is a tax on property values to fund operations of a taxing district. In this case, Orcas Island Library District is the taxing district. A district’s initial base levy amount is set by multiplying a voter-approved levy rate by the assessed value of all the properties in the district. Under state law, all tax levies may only increase by 1% annually plus a small adjustment for new construction. Because the annual base levy amount must by law stay relatively fixed, as assessed property values go up, the levy rate goes down.

Per RCW 27.12.050, library taxing districts cannot request more than 50 cents per $1,000 of property value.

-

Initiative 747, passed in 2001, established a “101% levy limit,” limiting the amount by which any taxing jurisdiction can increase its regular property tax levy. This means that the library system’s levy may not increase the total levy amount collected from current assessed valuation by more than 1% annually (the “levy lid”). The 1% limit restricts revenue growth every year, especially when costs are increasing by more than 1% per year due to inflation, salary and benefit costs, and other factors.

-

As the name suggests, a levy lid lift raises the levy rate from its current level to a higher one, resetting the base levy amount. Levy lid lifts must be approved by a simple majority. The lift happens once, and after that, the district’s levy may only increase by 1% for each subsequent year.

A single-year levy lid lift is the means to exceed the 101% levy limit. It allows the maximum levy to increase by more than 1% for one year only. It “lifts the levy lid.” The extra funds generated are put into a reserve fund to draw upon in later years as costs begin to exceed subsequent capped 1% increases.

-

Taxing districts (e.g., the Library, Fire District, School, Health Care District, Park and Rec, Cemetery District) are required by law to set a budget every year and submit it to the County. The funds for the budget primarily come from property tax. (In fact each taxing district had to be created by a vote of Orcas Islanders before your property could be taxed to support these entities.) In the case of the library, the Board reviews monthly expenditures and approves them as appropriate, so the Library stays within its annual budget each year.

Taxing districts are not businesses. They cannot sell more goods or charge more money to make more money to keep pace with inflation. They are also unlike employees who may receive annual cost-of-living increases or could switch jobs to earn more income or take second jobs to make ends meet.

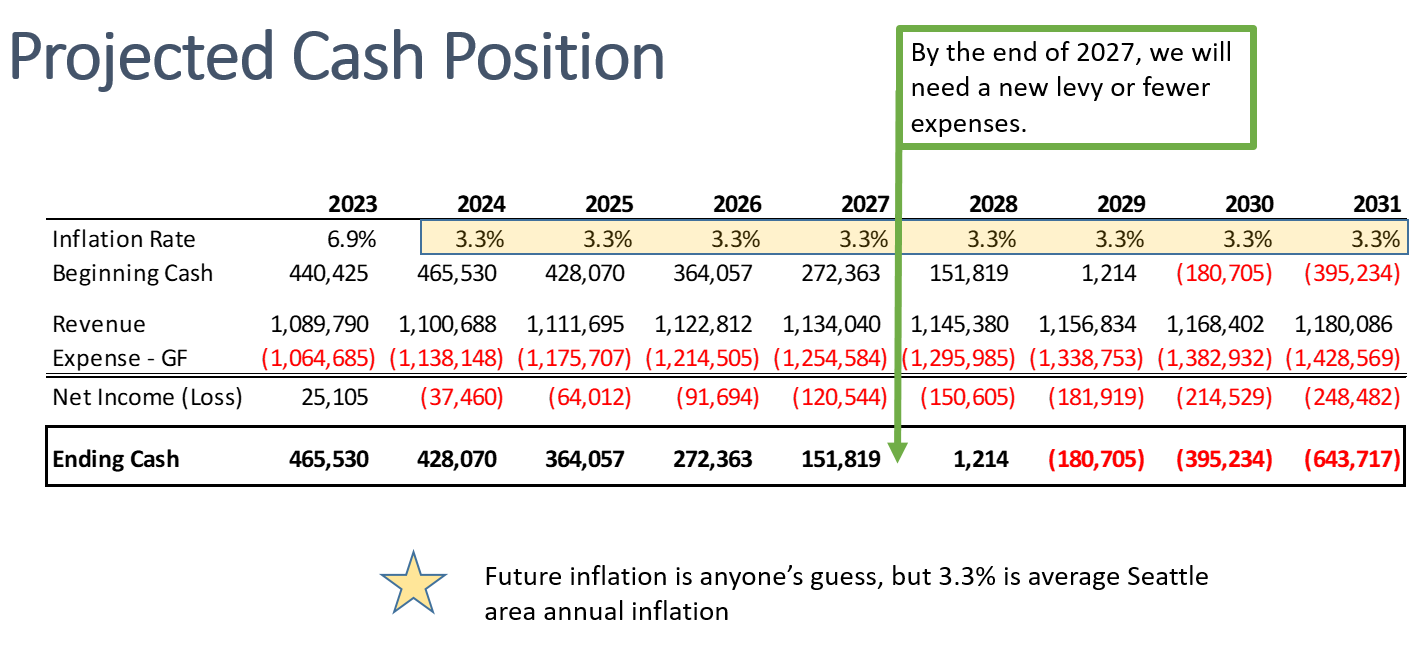

Instead, the property tax income approved by voters in a levy most often decreases every year due to the 1% levy limit while inflation increases. A taxing district cannot raise more money (beyond a voter-approved levy and applying for grants and donations) to keep the same level of services. Instead they either have to reduce services or ask for a levy lid lift on a regular basis.

The good news is this gives voters the opportunity to learn about their taxing districts and assess the services on a regular basis.

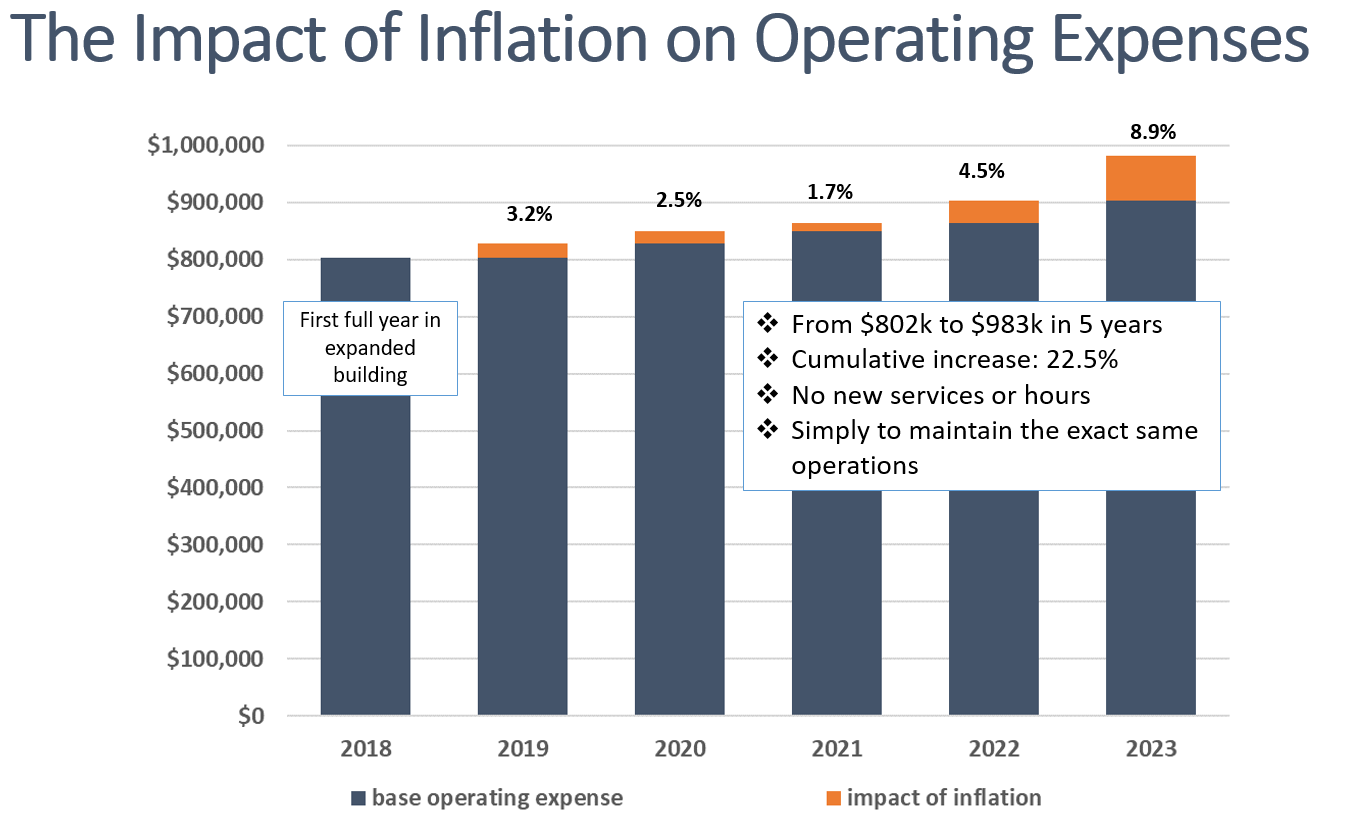

In a nutshell, inflation is higher than 1% per year and

library income (in the form of property tax) is capped at a 1% increase each year,

so even if the library does not increase services or purchasing, expenses will eventually exceed income.

In fact, even if the library makes annual cuts to services, staff, collections, and maintenance, expenses will eventually exceed income.

So why not just have fewer expenses?

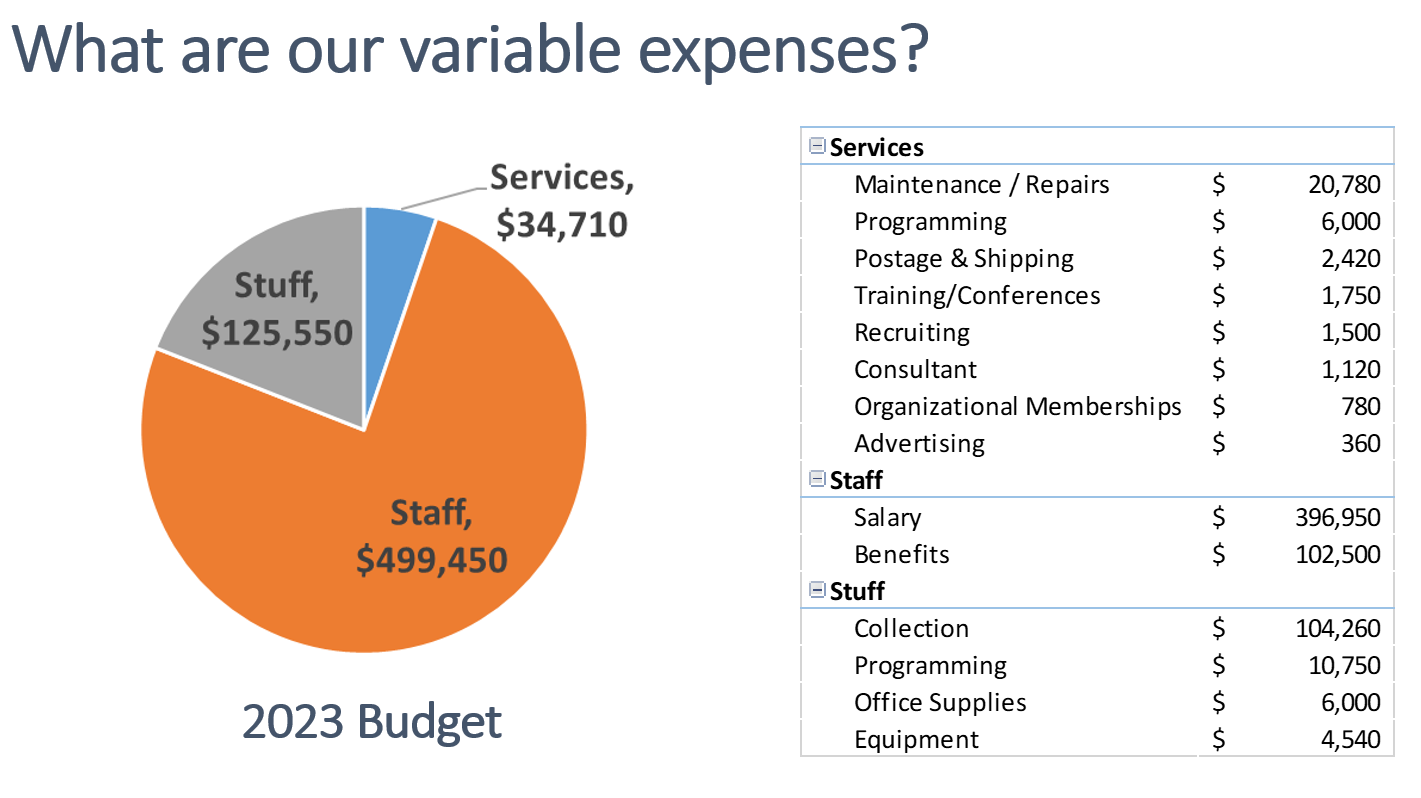

The short answer is that is what will happen if the levy is not partially restored. Forty percent of the library’s expenses are fixed (e.g., insurance). Sixty percent are variable and will be subject to reductions if the levy is not restored. Here is an illustration of the variable expenses from 2023 for a sense of what may be eliminated or reduced: